Net Income Type Vat Adalah. VAT will provide the UAE with a new source of income which will be continued to be utilised to provide high-quality public services. The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services.

VAT will provide the UAE with a new source of income which will be continued to be utilised to provide high-quality public services. It will also help government move towards its vision of reducing dependence on oil. Value-added tax (VAT) is a type of indirect taxation levied by a government on the amount that a business adds to the price of a commodity during production and distribution of a good.

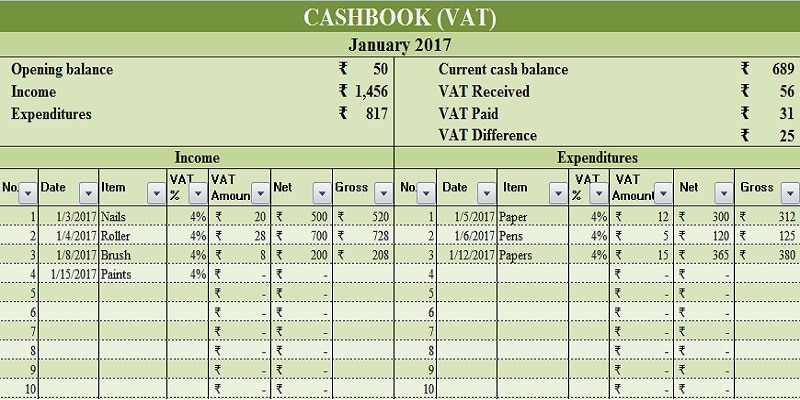

Add or extract VAT: calculate net amount without VAT in few keystrokes.

Governments worldwide continue to reform their tax codes at a historically rapid rate.

Advocates of VATs claim that they raise government revenues without punishing the wealthy by charging them more through an income tax. Value-added tax (VAT) is a type of indirect taxation levied by a government on the amount that a business adds to the price of a commodity during production and distribution of a good. The employer withholds taxes and other duties on income at source, and the employees receive the net amount after the deductions.

Leave a Reply